If you have struggled with a low credit score or past financial hiccups, walking into a car dealership can feel intimidating. You need a car to get to work, but traditional banks have already said “no.” This is where in-house financing usually enters the conversation.

It sounds convenient, a one-stop shop where you get the car and the loan in the same place. But is it a lifeline or a trap?

As a financial writer who has spent over a decade dissecting consumer debt and subprime lending contracts, I’ve seen in-house financing save livelihoods, but I’ve also seen it trap buyers in a cycle of debt. My goal here isn’t to judge; it’s to give you the clear, “inside baseball” knowledge you need to sign the paperwork with your eyes wide open.

In-House Financing Defined: What It Actually Means

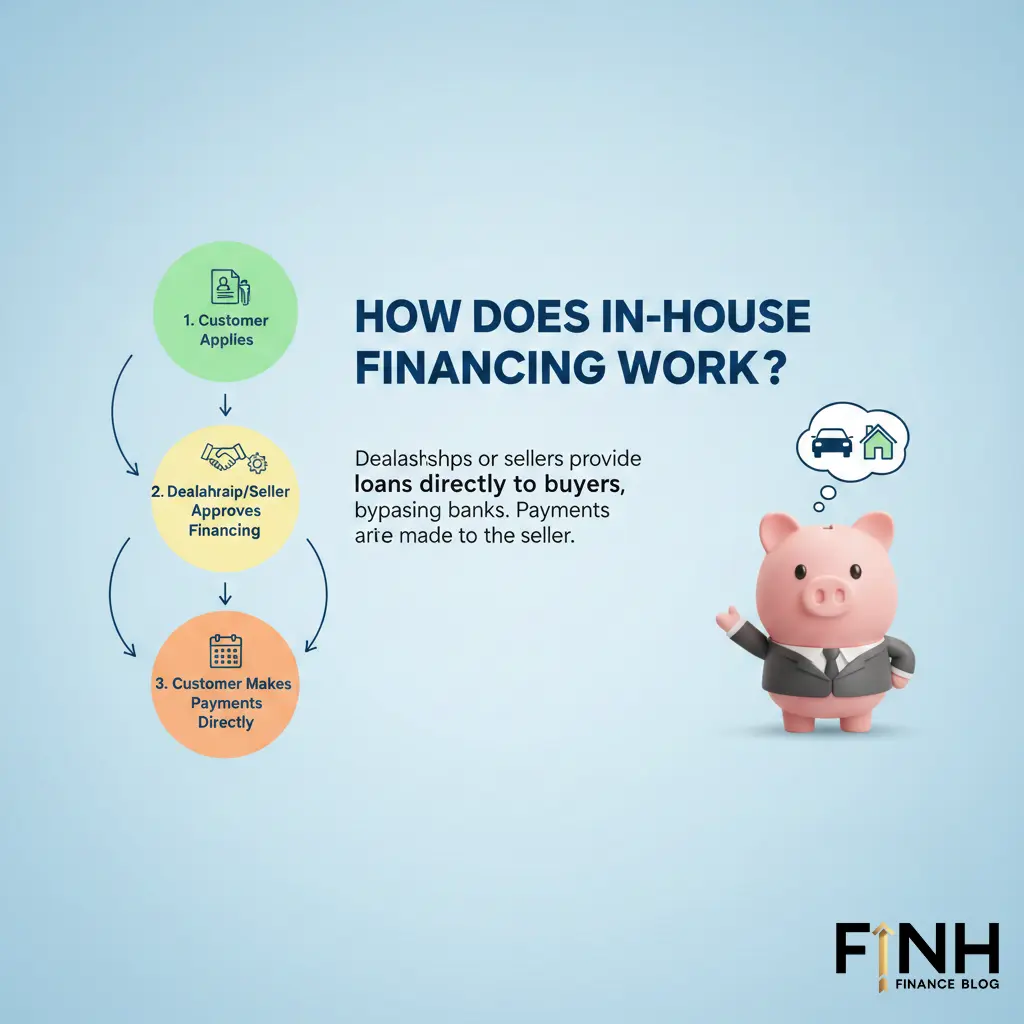

In-house financing occurs when a dealership extends a loan to you directly, rather than acting as a middleman for a bank or credit union. In this scenario, the dealer is also the lender.

You might hear this referred to by several names:

- Buy Here Pay Here (BHPH)

- Tote the Note

- Dealership Financing

How It Differs from Traditional Lending

In a standard car purchase, the dealer finds a third-party lender (like Wells Fargo or a local credit union) to buy your contract. You pay the bank.

With in-house financing, the dealer uses their own capital to fund the loan. You make your monthly installment (or often weekly payments) directly to the dealership. Because they aren’t bound by traditional banking regulations regarding risk, they can approve buyers that banks reject.

Expert Insight: I often tell clients: When you use a bank, you are a borrower. When you use in-house financing, you are a tenant of the vehicle until the final penny is paid.

How Does In-House Financing Work? (The Process)

If you are used to traditional car buying, the in-house process will feel backward. This is often called Reverse Shopping.

1. The Reverse Shopping Experience

At a traditional lot, you pick a car, then talk numbers. At a Buy Here Pay Here lot, the process starts with your wallet. The dealer will analyze your proof of income and down payment capability first. Based on that, they will walk you to a specific section of the lot and say, “These are the cars you qualify for.”

2. Requirements for Approval

While they often advertise “No Credit Check,” most dealers will still run a soft inquiry to verify identity. However, approval relies heavily on:

- Proof of Income: Pay stubs or bank statements.

- Proof of Residence: Utility bills (to ensure they can find the car if you default).

- References: A list of friends or family members.

- Down Payment: Usually substantial (often 10%–20% of the car’s value).

3. The Payment Schedule

Forget the standard monthly bill in the mail. Many in-house lenders require weekly or bi-weekly payments. Some traditional setups require you to pay in person at the dealership, though many modernized lots now accept app payments.

The Pros and Cons of Dealership Financing

Before signing a retail installment contract, you must weigh the immediate relief against the long-term cost.

The Benefits (Why People Choose It)

- Guaranteed Approval: This is the primary draw for borrowers with bad credit, bankruptcy, or repossession histories.

- Speed: The process is fast. Underwriting happens on-site, meaning you can often drive off the lot in an hour.

- Gap Transportation: It provides immediate access to a vehicle, which is often essential for maintaining employment.

The Risks (The Catch)

- Sky-High Interest Rates: While a bank might offer 7% APR, in-house loans often range from 15% to 25% or even higher, depending on state usury laws.

- Inflated Vehicle Prices: You might pay $10,000 for a car with a market value of $6,000. This creates a poor loan-to-value ratio, putting you “upside down” immediately.

- Strict Repossession Policies: Miss a payment by a few days, and the car could be gone.

In-House Financing vs. Bank Loans vs. Credit Unions

To make the right choice, look at the data. Here is a comparison of how different financial institutions handle auto loans.

| Feature | In-House Financing (BHPH) | Bank / Credit Union |

| Credit Requirement | Low / None (Income-based) | Good to Excellent (660+) |

| Interest Rates (APR) | High (15% – 30%) | Low to Moderate (5% – 10%) |

| Inventory Choice | Limited to what’s on the lot | Any car, anywhere |

| Credit Reporting | Inconsistent (Must verify) | Reports to all 3 Credit Bureaus |

| Down Payment | High Priority | Flexible |

When to Choose a Bank

If you have a credit score above 660 or a willing co-signer, always try a credit union first. You will save thousands in interest.

When to Choose In-House

If you have exhausted all other options and must have a vehicle to generate income, in-house financing is a viable bridge, provided you have an exit strategy.

The Hidden Realities: What Dealers Don’t Tell You

This section addresses critical gaps in most online advice. Understanding these mechanisms is vital for your protection.

The Churning Business Model

Most borrowers assume the dealer wants them to pay off the loan. In the subprime world, that isn’t always true. Some predatory dealers operate on a “Churning” model.

They sell a car for $1,000 down. The buyer struggles with the high payments and defaults. The dealer repossesses the car, cleans it, and sells it to the next buyer for another $1,000 down. I have reviewed cases where the same vehicle was sold 4 or 5 times in a single year. This is why the down payment is so critical to their profit margins.

GPS Trackers and Kill Switches

To mitigate risk, many in-house lenders install Starter Interrupt Devices (SIDs) or GPS trackers on the collateral (your car).

What they are: If you are one day late on your payment, the device can remotely disable your starter. The car won’t turn on until you pay.

Consumer Rights: Under the Truth in Lending Act and various state laws, the presence of these devices must be disclosed in your contract. If you find a device that wasn’t disclosed, you may have legal recourse.

Does In-House Financing Build Credit?

This is the most common misconception I encounter. Not all in-house lenders report your payments.

Traditional banks automatically report your payment history to Equifax, Experian, and TransUnion. Many BHPH dealers do not bother because it costs them money to subscribe to these reporting services.

Actionable Advice: Before you sign, ask specifically: “Do you report positive payments to the major credit bureaus?” If they say no, this loan will not help you perform credit repair. It will only drain your wallet.

How to Protect Yourself Before Signing?

Spotting Red Flags

Walk away if you encounter:

- Hidden Fees: Look for undefined “prep fees” or “admin fees” padded into the principal.

- No Inspection: If they won’t let you take the car to a mechanic or show you a warranty, the car is likely a lemon.

- Forced “Add-ons”: Be wary of expensive gap insurance or service contracts rolled into the loan without your clear consent.

The Real Cost Math

Let’s look at the Total Cost of Ownership.

- Scenario: You buy a $10,000 car.

- In-House Loan: 25% APR over 3 years.

- Total Interest Paid: ~$4,300.

- Total Cost: $14,300.

Compare this to a bank loan at 8%, where you would pay only ~$1,200 in interest. That difference is money you could be saving.

How to Get Out of an In-House Loan? (Exit Strategies)

You shouldn’t plan to keep a high-interest in-house loan for the full loan term. You need an escape plan.

Refinancing Options

After 6 to 12 months of on-time payments, your credit score may improve. This is the time to approach a credit union for refinancing. You are essentially taking out a new, lower-interest loan to pay off the predatory dealer.

-

Note: This only works if the dealer has been reporting your payments and if the car hasn’t depreciated too much (watch out for negative equity).

Voluntary Surrender vs. Repossession

If you truly cannot afford the payments, talk to the dealer. A voluntary surrender (giving the car back) is slightly less damaging to your credit score than a forced repossession, though both will hurt. It saves you the humiliation of a tow truck and potentially some late fees.

Frequently Asked Questions (FAQ)

Q: Do in-house financing dealerships do credit checks?

A: Most do not perform a hard inquiry that impacts your score. They rely on income verification. However, some may do a soft pull to verify your identity.

Q: Is in-house financing the same as owner financing?

A: It is similar in concept (the seller is the lender), but owner financing usually refers to real estate or private party sales, whereas in-house financing refers to a business (dealership) structure.

Q: Can I return a car financed in-house?

A: Generally, no. Unless the dealer offers a specific money-back guarantee policy, the retail installment contract is binding once you drive off the lot.

The Bottom Line

In-house financing is a tool, not a charity. It serves a specific purpose for those in a financial bind, but it comes with a high price tag, literally.

If you must use this route, focus on the total cost of ownership, ensure your payments are being reported to build your credit, and plan your exit strategy through refinancing as soon as possible.

Next Step: Are you currently comparing loan offers? Check your current credit report for free today to see if you might qualify for a traditional lender before heading to the dealership.

Thanks!